What is a Casino?

A casino is a place where people can play games of chance for money. They are usually built near or in combination with hotels, resorts, restaurants, retail shopping, cruise ships and other tourist attractions.

There are many different kinds of casinos around the world and the best one depends on your own personal preferences. For instance, if you like to be entertained by a live band then you might prefer a casino with a stage and lights or perhaps the casinos in Las Vegas are more your style as they feature a variety of shows and concerts.

They also have a wide range of facilities such as spas, pools and other amenities for their guests to enjoy. This makes them a great choice for a night out with friends or even a romantic weekend break.

Casinos are a major source of revenue for the governments of many countries and it is also an important form of tourism. In the USA, there are many large and small casinos spread across the country and they attract a number of visitors every year.

In modern times, most of the casinos have developed a slick and stylish image that appeals to both locals and tourists. They are often built around an impressive waterscape and have elaborate lighting effects.

The word “casino” comes from the Italian words, casin

There are a wide range of games on offer at casinos. These include slots, table games and poker. They are a great way to unwind and have some fun after a hard day at work or school.

Some casinos have special themed areas and rooms for certain types of customers, such as families or singles. Others focus on the more affluent, providing luxury accommodations and fine dining.

Another common practice at casinos is to give their customers free items or comps, which are typically alcoholic drinks, gift cards and tickets to shows. This is an attempt to attract more gamblers and boost their revenue.

Most casinos have a high security presence. They use a combination of a physical security force and specialized surveillance staff to protect their patrons and assets from criminal activity.

They also have a high level of customer service. For example, they will often let you leave the casino without paying if you’re tired of gambling or have lost a lot of money.

The casinos have also been known to use bright and sometimes gaudy floor coverings and wall decor that are meant to cheer up the players. The red colour is a popular choice for this reason.

The Venetian Macao is one of the largest and most famous casinos in the world, and it is renowned for its stunning design and lavish architecture. Its 850 gaming tables and 3400 slot machines generate over 70 percent of its income.

The post What is a Casino? appeared first on www.snvla.org.

The Financial Services Industry

Financial services are an important sector of the economy, with companies providing a range of products and services that support a variety of industries. These companies include banks, credit unions and brokerage firms, as well as insurance and investment companies.

The industry plays a major role in economic growth and development, providing an important source of capital for businesses to thrive. The industry also provides a variety of services to consumers that can help them manage their finances and get the most out of their money.

In general, financial services can be broken down into two different categories: tasks and goods. Tasks are things like cashing a check or using a credit card, while goods are products that last more than a single payment. Examples of goods are stocks, bonds, loans, commodity assets, real estate and insurance policies.

When it comes to the term “financial services”, many people tend to think of banking and lending. Banks are primarily concerned with saving and lending, but they do offer other services, too. Some of these services include deposit accounts, credit cards and loan servicing.

Another significant category of financial services is asset management. This sector handles pensions, hedge funds and mutual funds, among other things. The market for these services is growing rapidly as more and more people want to invest in a variety of financial assets.

Some of the most common kinds of financial services are mortgages, insurance and investment funds. This kind of service is mainly offered by banks, but it can also be provided by brokerage firms and credit card companies.

One of the biggest trends in the financial services industry is digital gig work, which can be a lucrative opportunity for both large tech companies and smaller local businesses. Digital gig work is often done from home, making it easier for people to access the funds they need.

In addition, there is a lot of potential for digital gig work to increase the number of business transactions conducted online. This could help to drive down the cost of debit card processing and make it more affordable for merchants to use PFM applications.

The financial services industry can be a rewarding and exciting place to work for those who are interested in helping others and who are willing to put in the effort and time to learn about their field. There are also a variety of opportunities for career advancement, especially in the area of financial planning, responsible investing and digital assets.

Financial Services can be a hugely diverse and lucrative industry, with many different areas of expertise to choose from. It’s important to understand the different areas of this industry before deciding on a specific career path, as each sector offers a unique set of skills and experience.

Whether you’re looking for a career in banking or insurance, there’s something for everyone in the financial services industry. As long as you’re able to provide exceptional service to clients, you can expect a fulfilling and successful career in the financial services industry.

The post The Financial Services Industry appeared first on www.snvla.org.

Home Improvement – What You Need to Know

Home improvement is the term used to describe renovations and remodeling projects that enhance the appearance or functionality of an existing property. It can involve anything from a small project like painting or changing the color of a room to a large undertaking, such as adding a deck.

The home improvement industry has grown stronger than many other industries in recent years, thanks to a variety of factors. For starters, aging homeowners are spending more than ever on renovating their homes. They’re also taking advantage of the fact that real estate prices are rising, which means more available equity to use for home improvements.

According to a recent report by Harvard Joint Center for Housing Studies, spending on home improvement has increased by 50 percent since 2010 and older homeowners are responsible for the vast majority of that growth.

Before you start a home improvement project, it’s important to consider your personal budget. You should also carefully weigh the impact of your project on your resale value and the amount of cash you’ll be able to recoup if you sell.

If you’re planning to make major home repairs, such as replacing a roof or installing new windows, it might be best to work with a licensed general contractor to help ensure the job gets done right and that you won’t end up paying more in the long run. Be sure to get references from other customers, and check that the contractor has all the necessary licensing in your state.

It’s important to establish a payment schedule with the contractor, and be certain to stick to it. Often, contractors will ask you to pay an initial deposit to hold the project in place and then ask for subsequent payments until all the work is complete. This is a common practice and can save you money down the road.

You can use a home equity line of credit to finance home improvements, as well. This type of loan allows you to borrow against your home’s equity, and you can usually spend the money however you want, so long as it doesn’t exceed 85% of your home’s value.

A home equity line of credit can be an excellent choice for larger home projects that require a significant amount of funding. You can use the line of credit for a single project or to cover multiple renovations. It’s a good idea to research the interest rates and fees associated with different home improvement financing options before making a decision, so you know which one will be best for your specific needs.

Using a credit card for a home improvement project is a popular option because they typically offer an introductory 0% APR period for a year or more. Some credit cards even give you the option of using cashback rewards or other incentives to pay off your balance.

If you have a high credit score, a home equity line of credit can be an effective way to borrow for a renovation. You can then repay the loan over a period of 5-30 years with fixed monthly payments.

The post Home Improvement – What You Need to Know appeared first on www.snvla.org.

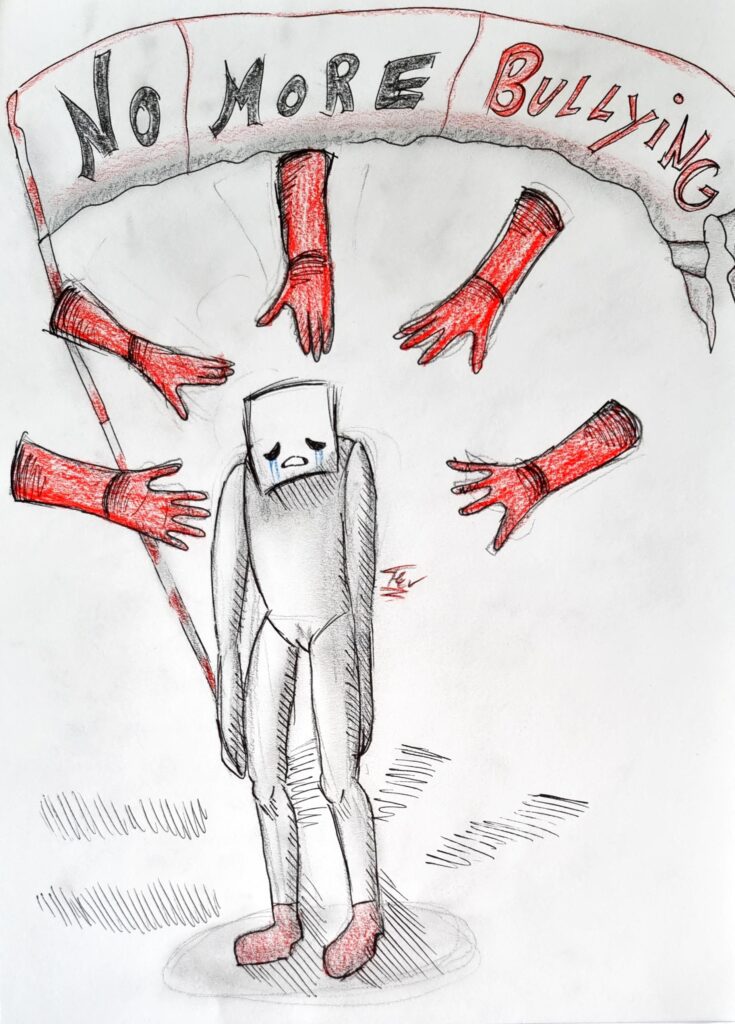

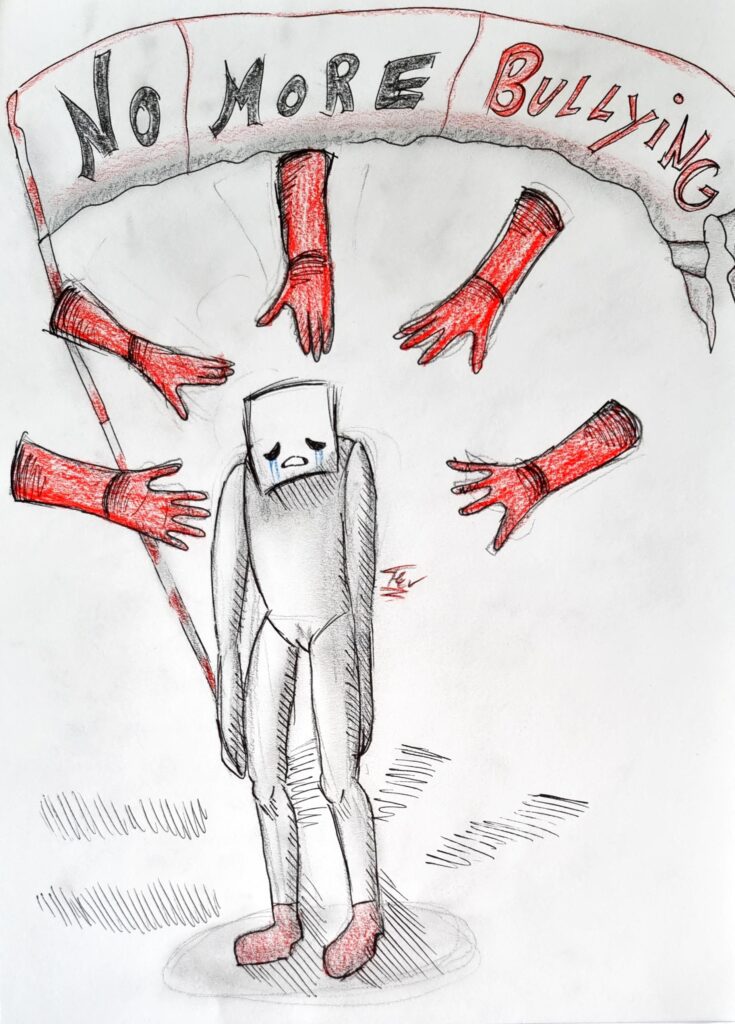

Campaign Against Bullying and Violence in Romania

“We have to be more responsible with our words and behaviors.” – 15-year-old girl from Bistrita

GNRC Romania organized a series of activities from May 25th to June 15th, 2022, to promote the importance of children in raising awareness to end bullying in schools. The activities were held in fifteen schools in Bucharest, reaching 2000 primary and high-school students, fifty-four teachers, and several members of the community, including faith leaders from the Christian and Muslim faiths.

“Each child has the power and the responsibility to contribute to a safer environment in school. All children should feel valued, protected appreciated, and free to express their opinions.” – Ms. Laura Molnar, GNRC Coordinator, Romania.

“No one deserves to be the victim of bullying.” – 13-year-old boy from Bucharest

The post <a><strong>Campaign Against Bullying and Violence in Romania </strong></a> appeared first on Global Network of Religions for Children.

The post Campaign Against Bullying and Violence in Romania appeared first on Arigatou International.

Campaign Against Bullying and Violence in Romania

“We have to be more responsible with our words and behaviors.” – 15-year-old girl from Bistrita

GNRC Romania organized a series of activities from May 25th to June 15th, 2022, to promote the importance of children in raising awareness to end bullying in schools. The activities were held in fifteen schools in Bucharest, reaching 2000 primary and high-school students, fifty-four teachers, and several members of the community, including faith leaders from the Christian and Muslim faiths.

“Each child has the power and the responsibility to contribute to a safer environment in school. All children should feel valued, protected appreciated, and free to express their opinions.” – Ms. Laura Molnar, GNRC Coordinator, Romania.

“No one deserves to be the victim of bullying.” – 13-year-old boy from Bucharest

The post <a><strong>Campaign Against Bullying and Violence in Romania </strong></a> appeared first on Global Network of Religions for Children.

The post Campaign Against Bullying and Violence in Romania appeared first on Arigatou International.